A Turning Point in Canada’s Uranium Industry

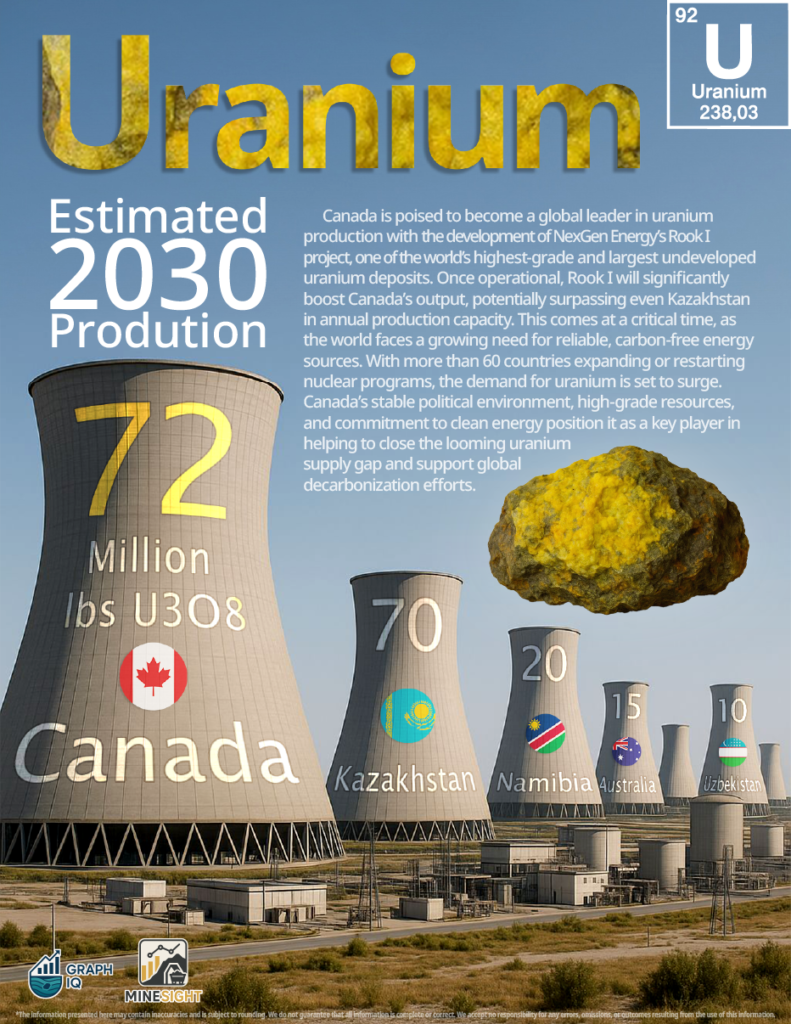

Canada has long been recognized as a rich source of uranium. Its flagship mines—Cigar Lake and McArthur River—have delivered nuclear fuel for decades. But with global uranium demand rising, Canada’s national production lags behind dominant producers like Kazakhstan. That’s on the verge of changing. NexGen Energy’s Rook I project is poised to redefine Canada’s role in the global uranium market, potentially making it the world’s top producer.

The Rook I Edge

Rook I isn’t just big—it’s exceptional. Housing the high-grade Arrow deposit, it has designs for producing around 29–30 million lbs U₃O₈ annually. When combined with Cigar Lake (~18 million lbs) and McArthur River (~25 million lbs), total Canadian production could reach 72 million lbs, topping Kazakhstan’s projected 70 million lbs by 2030.

What does this mean for Canada? It signals a shift—from being a strong player to becoming a central pillar of global uranium supply.

Navigating Regulatory Hurdles

Despite Rook I’s technical promise, progress has not been smooth. Recent delays in the final federal permitting phase—especially around environmental assessments and Indigenous consultations—have slowed the project’s timeline. NexGen, however, hasn’t stood still:

- Completed advanced engineering reviews

- Engaged Indigenous communities with updated agreements

- Submitted crucial Environmental Impact Assessment revisions

These actions underscore how NexGen is mitigating risks and reinforcing its project’s viability—clearly demonstrating commitment to both regulatory rigour and community trust.

Why Canada Needs This

a. Global Uranium Deficit & Climate Imperatives

Over 60 countries are expanding or building nuclear fleets. Many target Small Modular Reactors (SMRs) that require uranium. A looming global supply gap demands that countries with high-quality, responsibly-mined uranium step up. Rook I positions Canada not just as a supplier, but as a steward of clean energy resources.

b. Domestic Energy Security

Canada operates CANDU reactors—unique in that they use natural uranium, unlike most global reactors that require enriched fuel. Ensuring a reliable domestic supply will support existing nuclear capacity and future SMR plans. Rook I can fuel this ecosystem for decades.

c. Economic & Community Benefits

Rook I will bring construction jobs, long-term operations, technological innovation, and Indigenous partnerships—especially in Saskatchewan. A stable uranium industry can also help diversify Canada’s economic engines beyond hydrocarbons.

NexGen & Rook I: Leadership in Action

NexGen’s operational strategy is proving efficient and community-focused:

- Exclusive ownership (100 %) of Arrow means agile decision-making

- Innovative mine design, featuring underground tailings management for minimal environmental footprint

- Local and Indigenous partnerships, ensuring shared economic benefits

- Active supplier alignment, with major EPCM contracts driving engineering and procurement readiness

Their latest press releases reinforce this ethos: progress on engineering design, community engagement updates, and positive dialogues with regulators—all signalling a project ready to break ground.

Timing & the Path Ahead

According to NexGen’s current schedule:

Final Permitting (2024–2025)

NexGen completed the federal technical review and provincial EA approval in November 2023.The Canadian Nuclear Safety Commission (CNSC) has scheduled hearings for November 19, 2025, and February 9–13, 2026, after which a licensing decision is expected

Construction (2025–2026)

NexGen has stated that, with regulatory approval, they are prepared to start construction immediately, and they received site program approval for 2025 infrastructure works

Commissioning & Production Ramp-up (Target: 2028–2029)The company signed uranium offtake agreements from 2029 onward, indicating confidence in achieving operations by then

If permitted on schedule and market conditions remain favorable, Canada could emerge as the #1 uranium producer by 2030, meeting both global demand and national energy needs.

The current slide in global uranium prices, driven in part by market uncertainty and geopolitical instability, reinforces the need for diversified, reliable sources—countries and projects that operate under strict environmental, social, and governance standards. Rook I is tailor-made for just that.

A National Call to Action

To make this vision a reality, Canada must:

- Fast-track final approvals while maintaining safety and environmental stewardship

- Support export agreements and nuclear partnerships

- Commit to future-focused nuclear strategies, including SMRs

Canada has the resource, the technology, and the geopolitical capital. NexGen, through Rook I, has the high-grade deposit, the leadership, and the readiness to deliver. What remains is closing the gap between origin and execution.

Conclusion

NexGen’s Rook I project represents more than a major mine—it’s a symbol of Canada’s potential to shape the next wave of global clean energy supply. With it, Canada can rise to global uranium leadership—securing energy futures, supporting net-zero goals, fostering local prosperity, and ensuring global decarbonization efforts have the fuel they need.

The clock is ticking—but with focus and alignment, Canada and NexGen can power a new era of nuclear energy.